By

Did you know that only 2 percent of startups funded by venture capitalists last year were founded by women, and the numbers are actually declining? And that 99 percent of investment decisions at venture capital firms are made by men? This is according to data from PitchBook, which provides research on private companies and their funding.

Sara Brand’s venture capital firm is addressing the inequity by investing in startups with at least one woman on the founding or executive team. Launched in 2015, True Wealth Ventures of Austin, Texas, provides up to US $500,000 of seed funding to early-stage companies.

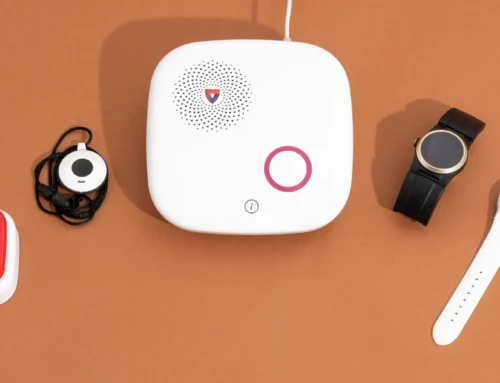

Its first beneficiary was UnaliWear, in September 2016. The startup, founded by IEEE Member Jean Anne Booth, is developing a smartwatch to help the elderly live independently at home. The watch will send reminders to take medications and dial an emergency number automatically if it senses the wearer has fallen. The watch is scheduled to launch in time for the Christmas holiday, and will be sold with a monthly service fee.

In this interview with The Institute, Brand discusses how more women can get the funding they need to launch and grow their companies.

Why is it important to invest in female entrepreneurs?

Eighty-five percent of consumer purchases in the United States are made by women. We believe women have an advantage over men in understanding consumers, and designing products that meet their needs.

A study conducted by McKinsey, “Women Matter: 10 Years of Insights on Gender Diversity,” found that the top quartile of Fortune 500 companies had women in leadership positions. On average, those companies had a difference in return on equity of 47 percent between the companies with women on their executive committee and those with none.

One reason for that success, according to the study, is women’s leadership style. Companies are moving away from a hierarchical management infrastructure and toward more remote and project-based teams—which requires effective collaboration and communication among employees. Those are areas in which women tend to excel. Women also tend to interact better with different personalities. They understand different emotional needs and are better at reading nonverbal cues. If someone is quiet, women are more likely to find ways to get ideas from them. If an employee is upset, they’re more apt to address the issue.

What are the challenges female entrepreneurs face?

When a woman is pitching her company to a group of men, it doesn’t bode well for her. People tend to consider it less risky to invest in people who remind them of themselves—which feeds into the boys’ club when 99 percent of decision-making VCs are men.

Female VCs are more likely to invest in companies where a CEO or founder is a woman. They are three times more likely than male VCs to invest in a female CEO. But only six venture capital firms in the United States have female partners who are actively looking for female entrepreneurs as part of their investment strategy.

Women often have to find alternate routes to raising funds for their ventures. For example, 42 percent of successful campaigns on crowdfunding platform Indiegogo are by women, and they raise more money than men’s projects do.

What should female entrepreneurs know before pitching a startup?

Women tend to under-promise and over-deliver—which is fantastic. But venture capitalists are looking for the big idea and the payoff at the end. Female entrepreneurs must be sure to paint that picture for them—what the success will look like if they invest—and then break their plan down into attainable milestones.

Also, try to get a meeting in a nonpitch environment, like a coffee shop, and not a boardroom. Women tend to perform better in one-on-one meetings. Also, seek out a female VC who understands your business and market.

How does your firm select proposals to fund?

We have invested in two ventures to date, and we’re raising capital to invest in more. We’re looking in two areas: health and wellness or products that are sustainable. This last could include, for example, an Internet-of-Things system to conserve energy in the home or developing packaging that preserves food.

We also look for a company that is “venture backable”—meaning investors can expect a large return. We seek companies we believe can be acquired within three to five years and will be valued at around $100 million when sold. Moreover, an entrepreneurial team is key. Are these the right people to take this product to market and be successful? Do I trust them? Are they transparent? Will they notify us if something goes wrong with their product?

What was it about UnaliWear that caught your attention?

The founder, Jean Anne Booth, is an electrical engineer by training and had already sold two other semiconductor ventures, to Apple and Texas Instruments. She has an amazing track record. She knows how to build hardware-based companies, and had come out of retirement to develop a smartwatch specifically for her mom.

Her mother refused to wear the “I’ve fallen and I can’t get up!” button around her neck. [Elderly people wear that Life Alert device to call for help if they have a health emergency.] Jean Anne looked for similar devices on the market and realized they were completely inadequate because they hadn’t kept up with technology. She decided to design one herself.

In addition to the medication reminder and calling an emergency number in the event of a fall, the watch can guide wearers who become lost, by voice-activated directions. The watch also never has to be taken off, because its batteries pop out to be recharged and the watch is waterproof. These last are important factors because most falls happen when people get up in the middle of the night or are in the shower.

Moreover, the UnaliWear smartwatch looks like a regular watch—which removes the stigma that many attach to wearing a medical alert device in public.

This article was originally posted here.