This article originally appeared on Crain’s.

By: Mary Ann Azevedo

Raising venture capital is never easy. But if you’re a startup with a female owner, chances are it will be even harder.

A recent Bloomberg analysis found that just 7 percent of companies that received $20 million or more in funding between 2009 and 2015 were owned by women. Companies founded by women also get less money – an average of $77 million compared with $100 million for male-led startups, the Bloomberg report found.

Another survey by the National Foundation for Women Business Owners and Wells Fargo & Co. found that despite the fact that 38 percent of U.S. businesses are owned by women, just 2 percent of the money invested by venture capital firms goes to women-owned firms.

There are countless theories as to why this is the case. Some say women are simply not taken as seriously as men. Others argue that results and track record matter more to VCs than gender. In response to the startling statistics, the U.S. has seen an influx of venture capital firms founded by women to invest in startups with female executives.

To better understand the challenges of women-run businesses raising capital, Crain’s asked a few venture capitalist specialists (below) to share their perspectives and experiences. A companion story to this piece, found here, explores the same subject with women business owners.

Kerry Rupp, general partner at Austin, Texas-based True Wealth Ventures

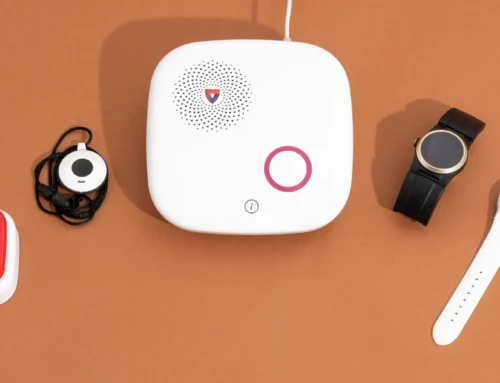

Serial entrepreneur and engineer Jean Anne Booth has an impressive track record; she has sold startups she founded to tech titans Texas Instruments and Apple.

But when it came time to raise money for the series A round for her latest startup, UnaliWear — a voice-controlled smart watch for seniors — the process was anything but a piece of cake.

Booth’s first institutional investor was Austin-based True Wealth Ventures, which dropped $500,000 in the round alongside 27 angel investors. Sara Brand founded True Wealth in late 2015 with the intention of investing in startups run by women in the consumer healthcare and sustainable products markets.

“This is an entrepreneur who had two successful exits with hardware companies acquired by Texas Instruments and Apple,” said True Wealth Ventures General Partner Kerry Rupp. “The fact that we were the first institutional money in the series A was surprising given her track record and market opportunity.”

Rupp noted the story of Washington, D.C.-based Village Capital, which eliminated the pitch process entirely from its standard practice. The replacement — a peer-selected investment model — led to about 36 percent of Village Capital’s investments going to women-led companies, which is significantly higher than the national average.

“By eliminating the pitch process, they had a 10-times increase in women-led companies that got through that process,” Rupp says. “This points to the fact that yes, a lot of women-led companies are not getting funded through existing channels.”

Rupp maintains that True Wealth’s mission is not just focused on diversity for diversity’s sake.

“We want to earn a great financial return, and we happen to think we can do that by investing in women-led companies,” she says.

Kate Mitchell, partner and co-founder of Foster City, Calif-based Scale Venture Partners

The topic of female-led businesses is a topic close to Kate Mitchell’s heart. She serves as co-chair of the National Venture Capital Association’s Inclusion and Diversity Task Force, which seeks to create and advance opportunities for women and minorities across the venture capital universe.

Mitchell points to a 2014 Babson College report that found that the number of early-stage companies with a woman on the executive team tripled from 5 to 15 percent from 1999 to 2014. But just 2.7 percent of the companies, or 183 of 6,517 companies receiving venture capital funding during that period, had a woman CEO.

CrunchBase conducted its own study and had similar results. From 2009 to 2014, CrunchBase recorded 14,341 U.S.-based startups that received funding. Of those, 15.5 percent, or 2,226, had at least one female founder. In 2009, 9.5 percent of startups had at least one woman founder – but by 2014 that rate had almost doubled to 18 percent.

“Both studies say the trend is good but the number is low. I don’t want to suggest that we are done. It’s good that we are trending up, but it’s not enough,” Mitchell says. “But it also says we need to keep up our efforts and get practical about the solutions we’ve put in place to help women get comfortable and investors get connected.”

Another study suggests that female founders are good for business.

In September 2015, Silicon Valley venture capital firm First Round Capital examined 300 of its portfolio companies and almost 600 founders, and found that the teams with at least one female founder did 63 percent better than the all-male founder teams. They looked at how much the company values had changed since the firm’s investment in them. First Round also found that three of its top 10 best performing investments had a female founder.

“It’s not just about trying to be fair,” Mitchell says. “It’s good for business.”

She says part of the issue is the lack of women as investors at venture capital firms.

“When there are women on a team, that firm is usually more open to investing in women,” she says. “Of course there are all-male teams that do diverse investing, but the likelihood is greater when there is a woman helping make decisions.”

Ron Heinz, founder and managing director of Salt Lake City, Utah-based Signal Peak Ventures

Signal Peak Ventures is interested in making its portfolio diverse, says founder and managing director Ron Heinz. It recently led in a $10 million investment round for Fremont, Calif.-based woman-led company called RackWare.

CEO Sash Sunkara is a first-time CEO but has held executive positions at HP and Brocade. Prior to Signal Peak’s investment, the company had demonstrated revenue and customer growth.

Overall, Heinz believes that at a high level, “there just aren’t as many women trying to raise capital as men.”

“Some of our other companies have female executives but few are led by a female CEO,” he says. “You just don’t see much of it. I expect it will change over time but I think we’re still in the early phases of that occurring.”