We hope that you’ve had a good start to the new year. We’re looking ahead with optimism, fueled in large part by the impact we see our entrepreneurs making, both in driving their business models forward and in making the world a healthier place.

Fund I Update

As you know, True Wealth Ventures focuses on women-led companies improving human and environmental health. The investment thesis is that women-led companies perform better financially, as reported in many studies, yet are an untapped market with less than 3% of venture dollars going to women-led start-ups and approximately 12% to those with a single woman on the leadership team. With women making 85% of consumer purchase decisions and 80% of healthcare decisions, we believe there’s an additional advantage for companies with women on the management team in designing products for, selling to and servicing these women customers.

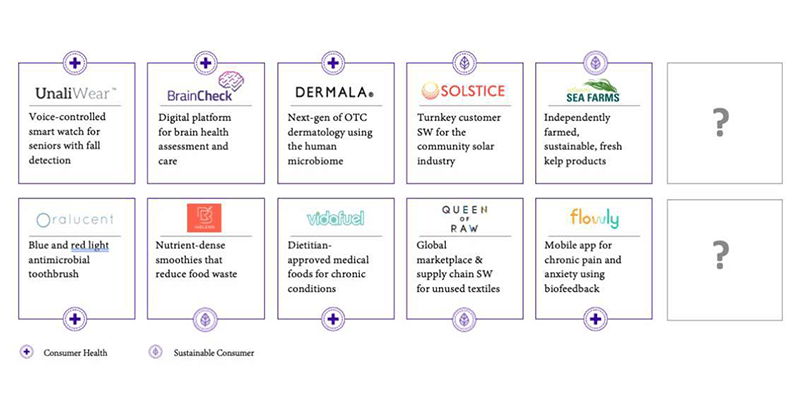

We are pleased to share that the strategy looks to be working. All ten of our Fund I investments to-date are active and in-revenue and have found the right strategies to navigate, and even leverage, the unexpected scenarios that 2020 threw at all of us. The investments represent a good blend of companies improving human and/or environmental health (represented below by the cross & the leaf, respectively).

We’ve now made ten of a planned twelve investments out of Fund I and are looking to wrap things up shortly with two final investments in the first half of 2021.

Click here to learn more about our companies and the women entrepreneurs behind them.

Click here to learn more about our companies and the women entrepreneurs behind them.

Fund II Approach

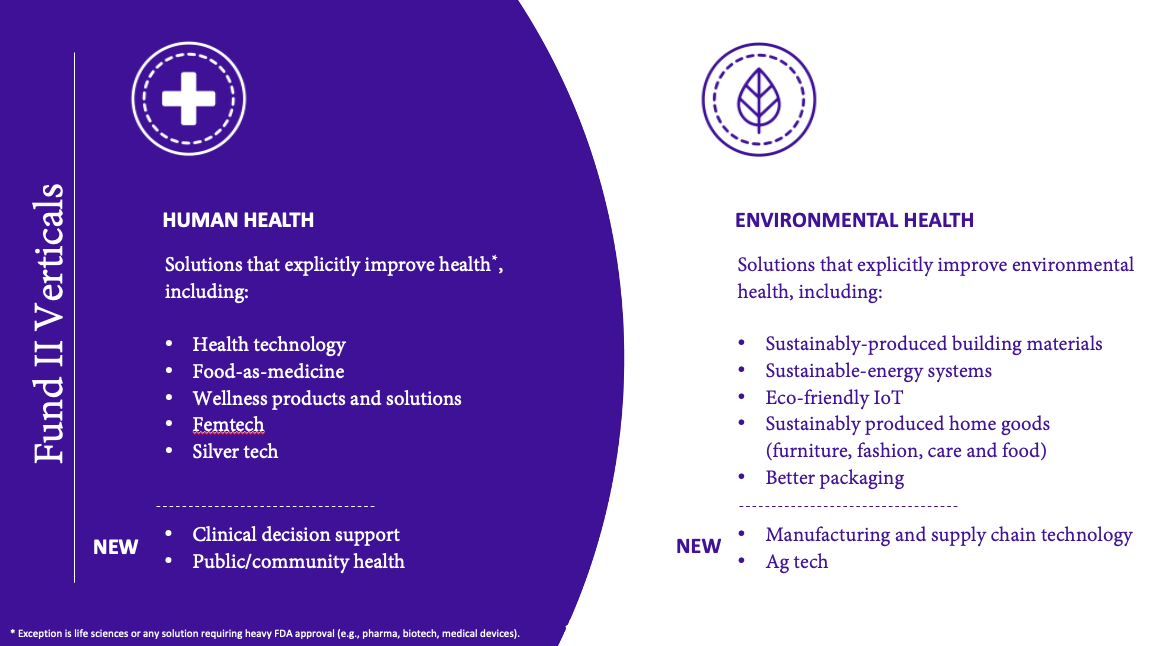

With Fund I off to the races and showing great prospects, we’re looking to double down on the same strategy with Fund II. The plan will be to invest in approximately 15 companies with first checks of up to $1M, where we’ll generally be leading deals and taking board seats. The focus will continue to be seed-stage, women-led companies that are explicitly improving human and/or environmental health.

In Fund I, we were a bit more narrowly focused on consumer-facing companies within those verticals, but we’ll be opening up the aperture some for Fund II. On the Human Health side, that may include clinical go-to-market pathways or population health solutions (though we’ll continue to shy away from life science and implantable medical devices and other heavily regulated FDA pathways). On the Environmental Health side, we’ll open up to solutions further up the supply chain that improve environmental impacts but don’t necessarily have consumer transparency.

As always, as you see companies that you think might be a fit for us, please reach out to tell us about them. We don’t expect to be making Fund II investments (i.e., into companies in this expanded set of market areas) until the second half of 2021, but we’re happy to have early conversations now with companies who will be fundraising then. And as noted above, we still have two investments to make out of Fund I into companies in our existing focus areas of Consumer Health and Sustainable Consumer.

Please reach out if you have any questions or introductions!

Sara Brand & Kerry Rupp

True Wealth Ventures

General Partners

Link to Read More: https://conta.cc/3ppFnOl