True Wealth Ventures to raise $30M second fund to back women-led companies

Mike Cronin, Staff Writer – Austin Business Journal

May 28, 2021, 7:36am EDT

As venture funding levels for women-led companies plunge even further below their male counterparts, Sara Brand and Kerry Rupp are investing where they can to reverse the trend.

The True Wealth Ventures general partners on May 27 filed paperwork with the U.S. Securities and Exchange Commission showing the Austin venture capital firm plans to raise a $30 million second fund.

SEC rules prohibit VCs from speaking about raising capital for an investment fund of this type. Commission regulations cap the number of investors in the fund at 99. If the firm succeeds in reaching the $30 million goal and 99 investors participate, the average investor contribution would be roughly $303,000.

The second fund, like the first, must consist only of accredited investors. Criteria to be considered an accredited investor include an annual income of at least $200,000 during the last two years, with the expectation that will continue, or an individual net worth that exceeds $1 million.

Brand and Rupp in 2018 closed their first fund at $19.1 million. Investments from the first fund generally have ranged from $500,000 to $750,000, Rupp said.

“When we closed that fund, it was the largest VC fund ever raised with a proactive gender diversity strategy,” Brand said.

As of October, 275 women-founded and led VC funds had been raised during the previous five years, Leslie Feinzaig wrote in Fast Company. She is founder and CEO of the Seattle-based Female Founders Alliance.

Those funds “represent a massive economy-wide opportunity,” Feinzaig said. “These funds are poised to invest in 7,000 companies in the coming years, potentially creating more than 80,000 jobs. When these companies have meaningful exits — like getting acquired, or listing in the public stock exchanges — the wealth created will go some ways to improving the gender wealth gap.”

True Wealth Ventures has made a total of 10 investments out of a planned 12, Brand said. Due diligence is occurring now for the final two, which could happen this summer. One of those investments could be in Austin, Brand said.

Roughly 80% of the limited partners who invested in the firm’s first fund are women, either a single woman or a woman investing on behalf of an investment firm or a family investment office, Brand said. “That seems unprecedented,” she added.

Many of the first fund’s limited partners consisted of “super successful, wealthy women who had never been asked if they wanted to invest before,” Brand said. “This was their first time investing in most cases.”

About 90% of the first fund investors are Texas-based and two-thirds live in Austin, Rupp said.

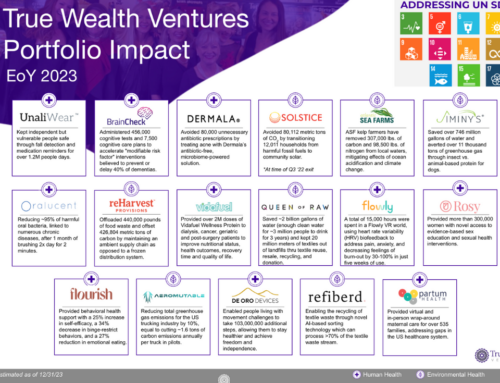

True Wealth Ventures is a mission-driven VC firm. Brand and Rupp target women-led companies in health care or that are making sustainably sourced consumer products. Investments include UnaliWear Inc., an Austin startup that sells a smart watch to assist senior citizens living independently and people with physical limitations, and BrainCheck Inc., a Houston-based maker of software that measures brain health.

Founded in 2015 by Brand, the firm focuses on leading seed-stage funding deals and taking board seats at the companies in which True Wealth Ventures invests.

Brand and Rupp in 2018 said women-led startups accounted for just 2% of VC funding. Last year, that figure fell to 1.5%, according to PitchBook’s VC Female Founders Dashboard.

This, despite evidence the two cite that women make between 80% and 85% of health care and consumer-purchase decisions. Multiple studies and reports during the past seven years alone have found that companies led by women or with women on the executive team outperform those that don’t.

A 2016 Harvard Business Review report found that women-led startups that receive funding from women VCs had a 32% higher exit rate.

True Wealth Ventures made the Impact50 2021 list, compiled by Maryland-headquartered nonprofit ImpactAssets Inc. That list highlights impact-fund managers throughout the world. True Wealth Ventures was the only Texas fund selected.

Link to Read More: https://www.bizjournals.com/bizwomen/news/latest-news/2021/05/true-wealth-ventures-to-raise-30m-second-fund-to.html?page=all