This article originally appeared in Tech Times

There is a new zeal among venture capital funds in aiming for health tech startups.

Oper8, VC fund of Ringleader Ventures or RLV is targeting healthcare providers and has hired Tony Burke as the firm’s industry director. Burke is a former American Hospital Association Solutions President and CEO.

The Oper8 Fund plans to invest heavily in health systems and hospitals to improve the business of healthcare.

“The Oper8 fund will invest in startups that can help health care providers deliver state-of-the-art care through efficient cost-effective operations,” said Mike Bechtel, Managing Partner of RLV.

Bechtel said there are plenty of health tech startups and growing firms are identified by the stature of the health startup as a retail, cybersecurity, or artificial intelligence company.

Women-Led Ventures Preferred

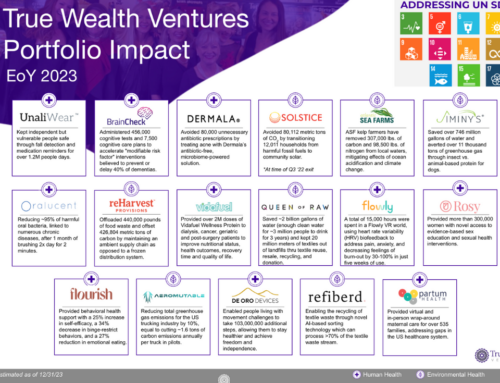

Some VCs are scouting for good healthcare startups especially those led by women. Take the case of True Wealth Ventures, co-founded by Sara Brand and Kerry Rupp.

The Austin-based venture capital firm is looking to invest in San Antonio area technology startups where women-led companies have clocked a bigger growth rate compared with other Texas markets.

True Wealth Ventures has set focus on early stage technology companies that are selling products or services in the health or sustainability sectors.

The average revenue for a woman-owned company in San Antonio is $1.6 million with an average 43 percent revenue growth.

“Many of those businesses are hamstrung by the lack of access to capital as opposed to ambition,” Rupp said, citing a study by First Round Capital, a San Francisco venture capital firm.

Rupp said women-led technology startups have been outperforming male-led startups. But that required access to capital during the seed stage. Her venture capital firm expects initial investments between $250,000 and $500,000.

As a faculty member of the National Science Foundation’s Innovation Corp., Rupp is keen on supporting emerging companies for grants to manage research and commercialize products.

The True Wealth Ventures Fund has already raised $4.7 million in 19 investors, during the summer of 2016 according to data with the U.S. Securities and Exchange Commission.

Rapper Jay-Z Floats VC Firm

Meanwhile, American rapper Jay-Z has floated a venture capital firm. The Arrive, a VC platform, was formed by Jay’s company Roc Nation to support younger startups for building brand and businesses.

Roc already owns the track record of having groomed many artists and athletes and is aiming to replicate the same in the corporate world.

Jay-Z owns Tidal and has investments in tech startups like Uber, Stance, and others.

Canadian VC To Encourage Women

Meanwhile, the formation of U.S.-Canada council on women in business has kicked off a renewed energy among women in founding their own businesses for better growth and thwart glass ceilings while serving in other firms.

MaRS IAF — an Ontario-based venture capital fund — has evidenced special interest in investing in women-led tech startups. In that process, it is also trying to address the under-representation of women on the boards of venture capital firms that are investing in startups.

Generally, venture firms invest 4 percent of their funds in women-led ventures.

In VCs, only 7 percent partners are women, which is lower than women represented on boards of blue-chip firms.

Nullifying the trend, MaRS IAF has invested three times more in women-led ventures than any other tech-focused VC fund in North America.

The VC find is also encouraged by BDC, the development bank of Canada in helping women entrepreneurs with a $50-million fund exclusively for female-led tech startups.