Austin’s venture capital landscape shows signs of recovery, with area startups raising $978 million across 80 deals in Q3 2024, marking a 44% increase from last year, according to data presented at Austin Tech Week.

During a panel discussion at Capital Factory Wednesday, leading Texas venture capitalists discussed how the investment climate has evolved since the market correction in 2022. While deal activity remains below the peak levels in 2021, investors noted that valuations have stabilized, and a renewed focus on sustainable growth and profitability has been renewed.

Charlie Plauche, General Partner of S3 Ventures, moderated the panel. Panelists included Kerry Rupp, General Partner of True Wealth Ventures; Krishna Srinivasan, founding general partner of LiveOak Ventures; Morgan Flager, managing director of Silverton Partners; and Tom Ball, Founding General Partner of Next Coast Ventures.

“The world has flipped,” said Srinivasan with LiveOak Ventures, explaining that companies can no longer pursue growth at all costs as they did in 2021. Instead, investors are prioritizing underlying solid business fundamentals and capital efficiency.

Though with a distinctly Texas twist, the panelists highlighted artificial intelligence as a significant investment theme. Rather than competing with Silicon Valley on foundational AI models, Texas startups are finding success in applying AI to specific industries where the region has deep domain expertise.

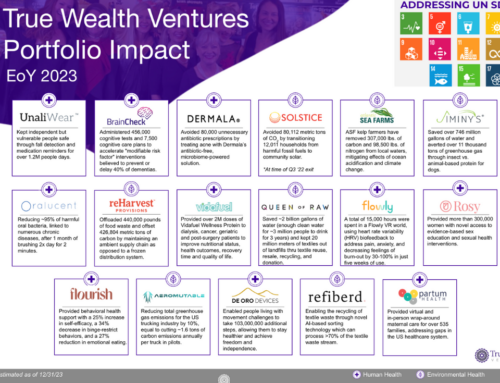

However, challenges remain. Rupp, with True Wealth Ventures, noted that despite increased attention to diversity, only 2% of venture funding goes to all-women founding teams. However, mixed-gender teams have improved, reaching about 20% of funding.

Year-to-date, Austin startups have raised $2.3 billion across 268 deals in 2024, positioning Texas as the fourth-largest state for venture capital investment behind California, Massachusetts, and New York.