Written By: Rebecca French Smith, Texas CEO Magazine

True Wealth Ventures Founding General Partner Sara Brand wants to change the numbers for women in venture capital investing.

In 2022 across the US, 2 percent of venture capital (VC) dollars went to all-female-founded companies, according to PitchBook. For companies with a male in the founding leadership, that number jumped to 14.9 percent. For all-female teams, the numbers have changed little in the last 10 years. In fact, VC dollars for all-female companies sat at 2 percent in 2012 and peaked at 2.9 percent in 2013. Meanwhile, the trajectory for male/female teams more than doubled from 6.9 percent in that decade.

True Wealth Ventures Founding General Partner Sara Brand hopes to change that narrative.

An Indirect Path

Brand didn’t start out in VC. With three degrees in mechanical engineering, starting at UT Austin and ending at UC Berkeley, Brand studied green design and manufacturing with minors in public health and energy and resources. She spent time in technical roles at large semiconductor companies, such as Intel and Applied Materials, early in her career, but she realized that if people used her research, it was more likely due to a business decision than a technical one.

In 2000, she pivoted and went to work at McKinsey & Company doing generic strategic management consulting in their San Francisco office, where the head of the semiconductor practice resided. As a result, she felt comfortable there while she learned how people made business decisions.

“It was sort of like getting an MBA through a fire hose,” Brand says, “but getting paid well.”

Through the combination of her experiences, she saw venture capital as an opportunity to combine her technical know-how with strategic management.

Her journey to becoming a venture capitalist started coming into focus.

“I thought, this is the perfect blend in terms of career,” she says, “combining all those skill sets and everything I love and found that it was true.”

At that point she recognized that to be successful she would need operational experience to be a better advisor and board member, but she had never gotten her hands dirty in terms of running a business. She joined Advanced Micro Devices (AMD) in California and had an opportunity to work directly for the CEO with the goal of obtaining more operational experience to eventually circle back to venture capital. The CEO sat in Austin, and that brought her back to Texas.

Back to Texas because Austin is where she met her husband when they were undergraduate students at the University of Texas. Here, she saw an opportunity in terms of VC firms. More specifically, she saw talent that was going unnoticed and an opportunity to refunnel VC funds into Texas from California.

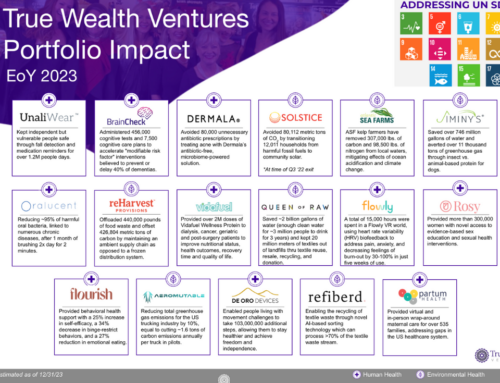

Brand spent more than 10 years at AMD before she established True Wealth Ventures in 2015 and started fundraising for the first fund, with the first close in the third quarter of 2016. The plan was to raise a $20-million fund and invest in about 12 companies at the seed stage and hold reserves for a little over half of the capital for subsequent financing rounds. The final close for their first $19.1-million fund was in January 2018, making True Wealth Ventures Fund I the largest traditional VC fund ever raised with an explicit gender-diversity investment strategy. Golden Seeds had raised a larger fund in 2011 alongside its angel group, but has since focused on operating as the largest angel network in the US that invests in early-stage women-led companies. Brand chalks this up to a win for Texas, and True Wealth Ventures invested in 12 companies out of fund one as planned. All were women-led and had core value propositions of improving environmental or human health. Geographically, they were strung from Maine to southern California. Three of the 12 were in Texas—Austin, Houston, and Dallas.

Fund two at True Wealth closed in May 2022 after hitting the hard cap of $35 million. The plan is to invest in 15 seed-stage companies with this second fund, still women-led and with core propositions of improving environmental or human health. With this fund, Brand says, they will be writing slightly larger checks. With fund one, the average check was $500,000 at the seed stage; fund two checks will be up to one-million-dollar first investments and over half the investment capital is again reserved for follow-on investments in the existing portfolio of 15 companies.

Educating Women on Investing

One commonality between the two funds is that 80 percent of the investors were women. In fund one, 90 percent of the investors were also from Texas. A True Wealth Ventures poll of those investors revealed that of those women, most had never invested in a venture capital fund before, and most had never been asked to or invited to invest in a VC fund before.

“We realized that it was really important to try to get the word out to more women about what a venture capital investment is,” Brand says, “and educate a little bit about how it works and why it is important for women to invest.”

They also found that their investors were interested in investing more capital directly into the portfolio companies, to the tune of an average of about 50 percent of additional capital on top of what the fund invested. This is often referred to as co-investing, and when it is not done through a fund it is considered angel investing. Many of True Wealth Ventures’ investors made their first direct startup investments as part of these co-investment opportunities, and Brand talks about this mechanism as another important pathway to activating more capital into the female founders’ innovation ecosystem.

Truth Wealth Ventures CEO Sara Brand on women in the world of venture capital.

What sets True Wealth Ventures apart in the world of venture capital?

We invest exclusively in women-led companies. We define “women-led” as at least one full-time woman on the founding or C-suite team at that early stage. So, it doesn’t have to be all women or a woman CEO, but that is the case most of the time for our portfolio; 15 out of 16 companies to date have a woman CEO.

We invest in companies whose core value proposition is improving environmental and/or human health as well. So, we’re considered an impact fund for our gender-diversity focus but also for the markets in which we invest. We invest at the seed stage, so it’s very early. Usually, we’re the first institutional investors beyond angels and friends and family, and we invest across the whole country.

What was the impetus for founding True Wealth Ventures after being in the tech field for 15-plus years? Was this always an interest, championing women-led companies?

It was not. At AMD, I spent a little over 10 years working for three of the four CEOs during my time there—doing strategy work still, a lot of mergers and acquisitions, so seeing the other side of the venture capital equation in terms of acquiring VC-backed companies and integrating them into the big company.

I was asked to be the executive sponsor of their global women’s forum because I was the only woman vice president in the entire company that had any technical or operational background. I think there were 12 other women VPs, but they were all in general and administrative functions, either HR, marketing, finance, or legal. I was the only tech or operating VP.

That was super eye-opening—the fact that I didn’t believe it at first and the fact that I hadn’t been aware. I realized because my background had been in mechanical engineering, in venture capital, in semiconductor tech—my husband and I started a brewery—my whole world was so male-dominated. I was totally blind to it, and so I just didn’t even realize. Then once I realized, “Oh my gosh, how can this be that I’m the only woman VP here that has tech or operating background in this very engineering-oriented company?” I really started doing my homework as to how this could have happened.

McKinsey & Company was one of the first to do some real research around this. They showed that the top quartile of Fortune 500 companies with the most women in senior leadership positions saw seriously higher financial returns. I realized this was the most powerful business lever I had ever seen and how easy it seemed to just hire, retain, and promote more women to improve business performance. However, I began to appreciate how challenging that actually was—to turn the unconscious, huge tanker ship.

In the meantime, I knew I wanted to get back into VC one day and started looking into those numbers and realized the same financial outperformance numbers existed, in terms of these women-led, VC-backed companies seeing much better returns, yet they were still not being invested in.

Despite the data being out there, the numbers were not changing. There were very few funds that had a gender-diversity strategy, and they were on the coasts with nothing in Texas or the whole central United States.

I realized it combined everything I loved and wanted to do: be in VC, invest in women, invest in companies improving human and environmental health.

Women start companies that tend to have more of a positive impact in the world because they’re solving problems that they’re aware of or that they have, or their friends and family have. So there tends to be more companies improving environmental and human health that are women-led.

Are there any other factors you consider when considering companies to

invest in?

First, they have to be within our investment scope and improving environmental or human health as a core element of their business.

In addition to the stage being right, the amount being raised by the company also needs to align with our thesis. We typically invest in rounds between $1.5 million to $4.5 million, often leading the deal and taking a board seat.

The most important thing is that they really need to be looking at very fast growth and a big exit. Most VCs really look for a company to IPO and have a huge exit that can return the entire fund. We have a little bit of a different take on that. We look at the fact that most of these exits happen via acquisition, versus an IPO, and most of those acquisitions actually happen pretty early on in the startup lifecycle, after seed or series A. The latest medial deal valuation at acquisition was $65 million. So, it’s not huge. In order for that type of exit to be great for us, we need to make sure that the company hasn’t raised a bunch of money. So, we look for capital-efficient companies that can get to that $100-million-ish exit valuation within a five-year timeframe or so without raising too many or large rounds. That way we can still return a top-tier multiple to our investors by being capital-efficient.

But still, even a $100-million exit, that’s a really fast scale. It has to be an entrepreneur that’s really looking at that kind of path, and most aren’t. It’s the rare company that’s really looking for a true kind of venture capital investor.

Do you have any practical tips for someone pitching to your firm or any VC firm?

I really hope that eventually there will be some great matchmaking tools of “What kind of company is this, and what kind of investors should you pitch to?” But, I haven’t seen it yet. People have tried, but it takes a lot of homework, unfortunately, to find who are the right funds to pitch.

First of all, do you want a venture investor? If you do, then who are the funds that invest in your space, at your stage, and are they the right type of partner you want to go into business with for the next five to 10 years? If they want a board seat, that’s an even tighter relationship. It’s a very important relationship that no matter if everything goes as well as planned, there’s still going to be major ups and downs. So, it’s somebody that you really want to be able to be in business with for the long term.

Do your homework to determine whether it’s a good fit—so you’re not wasting your time pitching somebody who doesn’t even invest until series B or until they can write a $10-million check—and then craft that email to say why your company is a fit.

It’s not rocket science, but somebody taking the time to see what we invest in and saying why this opportunity is a fit for our investment thesis goes a very, very long way.

We’ll definitely dig in. We have a whole deal-flow assessment machine, but we will see it if somebody takes the time to really target us and explain why it’s a fit. Most entrepreneurs don’t, and I think it’s because it’s such a heavy lift on their end trying to figure out who the right investors are to approach. But it goes a long way if they can craft that personalized pitch.

Apart from True Wealth, how have you seen diversity and inclusion in VC efforts evolve in recent years?

Maybe this is the sad part of the conversation. What I’m seeing is a lot more talk about it, a lot more awareness, but when you look at the numbers, they still haven’t changed. It’s surprising.

When we started fund one, we thought, okay, great. This is a great investment opportunity, but everyone’s going to catch on. We’re trying to spread the word. People will see that these women-led companies outperform, and then everybody will dive in. Not the case. During COVID it went below 2 percent of VC dollars going to women.

There’s a lot of industry infrastructure that isn’t set up for this kind of change. There’s more awareness, but that’s why we really think getting more women to invest in VC firms is the fastest way to change the gender dynamic because women care two times as much in terms of the diversity of the teams that they invest in.

When there’s a woman at a VC firm—and most firms don’t have any kind of proactive gender-diversity strategy, so it’s just there’s a woman at a random VC firm—that firm is two times more likely to invest in a company with a woman founder and three times more likely to invest in a company with a woman CEO. So having more women at the table, or just in the room, not even a table, just in the room, leads to more investment in women entrepreneurs.

And same with women general partners. I think it’s more likely that a woman will invest in a woman GP. Plus, women are estimated to control two-thirds of all US investible assets by the end of this decade. They are largely not investing in VC now, so it’s actually very important that

they do invest because if they don’t, our innovation economy could dry up without

that investment capital.

A little pivot. How would you define your personal leadership style?

Back in the day, I was told that I have a combination of strategic thinking and seeing the bigger vision by connecting all these dots that other people aren’t necessarily connecting, but then I also have the operational detail to go and get it done or manage the people that are getting it done. I don’t know if that’s considered a “leadership style,” bridging strategy to detailed operations.

Who or what has had the biggest influence on your leadership style, how you lead your company?

I struggle with this question because when I was in my corporate career, I didn’t have role models. I had great mentors, but they were all older men. They weren’t people that looked like me or that I related to in terms of, “Oh, that’s who I want to be when I grow up,” and so, I never figured it out. I went to all kinds of executive coach things and 360-degree evaluations paid for by the company to figure out “what to do when I grow up,” and I realized I didn’t know because I didn’t have any role models. I was in this male-dominated world. So, my biggest influence was myself, looking inward and asking, “What do I want to do?”

There’s a phrase: You have to see it to be it. And I didn’t see it. So, I did a lot of self-reflection to figure out what I wanted to do.

What advice would you have for a female leader who is looking to make an impact in the world? What challenges do they face that their male peers may not?

Really think about what problems you’re attracted to in the world. What are the things that you want to fix that really bother you? And what energizes you? What do you do well? What are your skills? Try to figure out that unique thing in the world for you to do because then almost everything else doesn’t matter. But then, for women entrepreneurs, I also tell them that unfortunately it’s culture against women. It’s not men against women. It’s culture against women. People, women and men, like promoting women based on results, not on potential. Whereas men get promoted on potential. It’s the same thing in the investor community. Women get asked these prevention-oriented questions like: Well, what if you’re not able to raise that much money? Or what are your skill-set gaps on the team? Whereas men get asked promotion-oriented questions: Well, what if you raised $5 million more than that, then how big could you be?

So it’s this kind of death by a thousand cuts, just these little things that end up making it harder for women to raise money, harder for women to get promoted. It’s not that the guy is after you. It’s just culture; it’s just this unconscious bias. So unfortunately, you do have to dance in heels and backwards, but that’s the world we live in. So being aware of how to make your situation better with a smile on your face while you’re doing it will lead to better results; it is just the way it is for now.

What’s the best piece of advice you’ve ever received?

It’s something like: Don’t let the things that matter least take over the things that matter most. It’s really learning how to say no to things so you can say yes to the things that matter most. I have a hard time saying no, and it’s a huge part of my job. So, I have been able to shift it in my mind: Saying no to something that doesn’t matter the most to you is saying yes to what does matter the most. So, it’s saying yes to what matters the most. I’m still working on it.

Does it take some soul-searching to really think about how something may or may not affect your end goal?

Yes. I feel like I spend way too much time saying no to things. Once I decide to say no, I’m like, “Oh well, should I? Or should I not?” I do think it’s a bit of a woman problem, too. It’s like we’ve got guilt about saying no. I’m getting better at it. It does take more soul-searching than I’d like it to.

Let’s talk about (512) Brewing Company for a bit. That’s your other entrepreneurial adventure with your husband that began long before True Wealth Ventures. What was it like starting the brewery in Austin?

It was our first child, in a way, as we met as undergrads at UT in mechanical engineering. He home-brewed to the point of taking over our refrigerator, and there were two kegs and no shelving in our refrigerator in California. It was just a little out of hand.

When we moved back to Austin from the Bay Area, all the breweries were pretty much gone that we had grown up with at UT. He had always dreamed about starting a brewery in retirement, but when we saw, wow, there’s really no beer here anymore and there was no IPA, which was my personal favorite style, we finally took matters into our own hands. The day I went back to work from my first maternity leave, he stayed home, quit his startup, and started the brewery.

What’s in the future for True Wealth Ventures?

To hopefully change the gender dynamic in the industry. We continue to invest in fantastic women entrepreneurs that are solving really critical problems to the environment or to human health. We focus on getting them wildly successful exits so they can make a lot of money and scale their solutions into the world, and our investors, 80 percent women, can also make fantastic returns. Women have been shown to reinvest 80 percent of their wealth back into their communities, their families, their health. So that’s the long-term goal, to have this virtuous cycle of women doing great things, making a lot of money, and continuing to reinvest that into creating a better world.