Now that we have completed the selection of all 12 True Wealth Ventures Fund I portfolio companies and started investing out of Fund II, we have several things to share: a Fund I portfolio impact report, a new investment out of Fund II, and a reminder of what we are investing in out of Fund II.

Fund I Report Card: Showcasing Our Portfolio Impact

As you likely know, True Wealth Ventures is an impact investing firm, and last year we were named to the ImpactAssets 50 2021, a global list of impact fund managers across sectors and asset classes, as an Emerging Impact Manager.

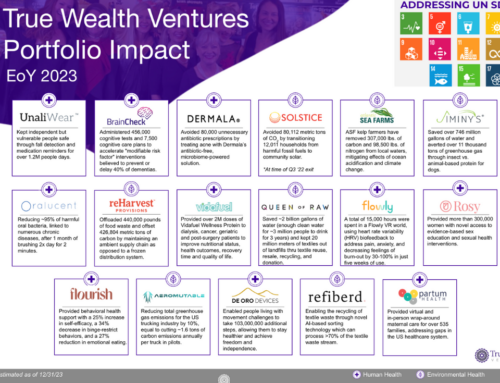

Having now completed the selection of the 12 companies for Fund I, we have prepared our first Fund I impact report, using GIIN’s 5 dimensions of impact as a framework to gather the portfolio’s cumulative impacts through the end of 2021. View the high-level summary below and please reach out if you want to see the full report:

Fund II is off to the races!

In the meantime, since we’ve already raised over half of our targeted $30M Fund II, we’ve lost no time in investing in new companies. In the fall, we told you about Flourish — helping women get healthy for good — and are now introducing Aeromutable. Stay tuned for news about a third investment in the works right now!

Aeromutable is bringing aerospace technology into the trucking industry through designing and manufacturing aerodynamic modification systems that increase vehicle efficiency and safety. Aeromutable’s first product is a non-intrusive trailer add-on system that improves aerodynamic performance and provides 3 times the fuel savings of its nearest competitors, saving 9.76 billion gallons of fuel per year in the U.S. alone and providing the trucking industry the ability to increase profitability while massively reducing their carbon footprint.

Co-Founder and COO Sandra Monosalvas-Kjono, PhD, has three degrees in Electrical Engineering from Stanford, and leadership experience as a US Navy helicopter pilot & SPAWAR Systems Center Pacific Project Manager. She is also the Lead Sensor System Design Engineer for the company.

What Deals Should You Send Us?

Please let us know about companies that could be a fit for our investment criteria:

Women-Led: At least one full-time female founder or C-suite executive with significant decision-making authority

- Impact must be core to the business, and the company must have data showing proven outcomes

- Software, hardware, or CPG

- No deeply clinical healthcare solutions (i.e., no implantable medical devices, surgical tools, biotech/pharma/life sciences, or other heavily FDA-regulated solutions)

- No industrial / utility-scale solutions on the environmental side

Early-stage: Generally Seed-stage companies raising smaller rounds (under $5M). We tend to lead priced equity deals with $500K-$1M first checks (plus our LPs often co-invest another 50%) and take board seats.

You can always direct companies to read our “About” page and apply. Please reach out if you have any questions or introductions!

Sara Brand & Kerry Rupp

True Wealth Ventures

General Partners