This article originally appeared in Rivard Report

Data and timing are on the side of Austin entrepreneur Jean Anne Booth, whose latest invention is a smartwatch aimed at senior citizens like her mother, who still lives independently in her San Antonio home.

According to a study by the Kauffman Foundation, venture-backed companies with a woman CEO, like Booth, showed 35% higher return on investment and 12% higher revenue growth, while using one-third of the capital.

But Booth’s prospects for her latest venture got even better when she met Sara Brand and Kerry Rupp, partners in True Wealth Ventures, who say they know why women are not just persevering, but also finding success.

They will deliver a talk on that topic Wednesday, March 1, during the second annual San Antonio Startup Week, which kicks off Feb. 27 and continues through March 3 at the Geekdom Event Centre. Their presentation, sponsored by the San Antonio Angel Network at Paramour Bar, is titled “Outperformance and Opportunities: Women Inventors and Women Entrepreneurs.”

To reserve a spot, click here.

“It’s a growing, dynamic environment that’s maturing,” said Luis Martinez, Trinity University director for the Center of Innovation and Entrepreneurship, about San Antonio Startup Week. “What’s remarkable is how incredibly collaborative and cooperative it is, I’ve never seen anything like it.”

Martinez said this year’s event also will offer a collegiate showcase that highlights student startups from Trinity, UTSA, St. Mary’s University and University of the Incarnate Word, as well as more sessions like the one by Rupp and Brand, who also are presenting “Empowering Entrepreneuring Women” on March 1.

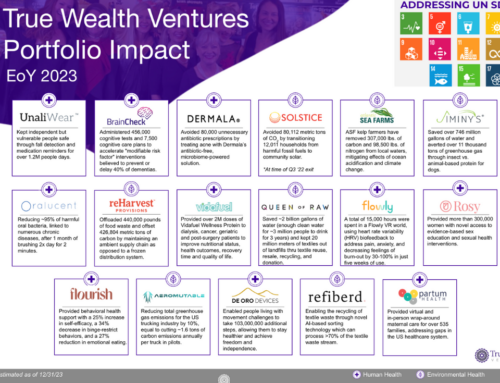

True Wealth is a venture capital fund the two women began in Austin less than one year ago to invest in women-led companies with “products and technologies in the consumer health and sustainable customer sectors that efficiently address the next generation of challenges.”

Women make 85% of consumer-product purchase decisions and 80% of healthcare decisions, according to Bloomberg. So it stands to reason, according to the True Wealth partners, that when women serve on a management team that designs, sells, or services products for customers in these markets, it’s a competitive advantage.

For Booth, it was a perfect match-up.

“We were looking for financing. I knew Sara and Kerry from startup events and women’s events around the Austin area,” Booth said. “I watched Sara take True Wealth from concept to actively funding companies – and she watched me take UnaliWear from concept through 10 stages of prototyping. So when we were looking for the money to get our user test underway, I went straight to Sara.”

Brand has degrees in design and manufacturing from UC Berkeley and mechanical engineering from UT Austin where she now serves on the Cockrell School of Engineering’s external advisory board. She worked in various executive-level roles in the semiconductor industry for 20 years and managed a $150 million venture fund with four others in one of the top 10 firms in San Francisco. More recently, with her husband, she founded the draft-only (512) Brewing Company.

“Everything [in my career] was very, very ‘male,’” Brand said. “But then I was asked to be an executive sponsor of the Global Women’s Forum when I was at Advanced Micro Devices. And they asked me to do that because I was the only vice president in Austin who was a woman, who had any tech or operational background. That was the first time I realized I was so rare. So I started doing my homework.”

No sooner had Brand decided to seize the opportunity than she realized she had never met another woman doing venture capital work in Austin. Then she was introduced to Rupp.

As CEO and general partner at DreamIt, a global startup accelerator, Rupp grew its programs to five cities, raised a $20 million follow-on fund and helped to launch of over 150 companies. Before DreamIt, she founded her own business, a travel service that designed international excursions for women. Rupp has an MBA from Harvard Business School and a bachelor’s degree from Duke University.

Working together now, both Brand and Rupp are deeply involved in the state’s entrepreneurial ecosystem, fostering tech innovation and gender diversity.

They consider women-led companies an untapped market for investors. Only 3% of venture dollars currently go to startups at which women are the leaders, and only 15% to those with women who serve on the management team, according to the Diana Report. Yet a report by the early-stage venture capital firm First Round Capital showed companies with a female founder performed 63% better than investments with all-male founding teams.

But even True Wealth is a minority, at least among venture capital firms.

“If you look across the country at firms, in terms of early-stage VC funds with some women as partners, with any kind of gender diversity strategy, there are only six out of tens of thousands of firms out there. They are in California and New York, and there’s nothing in Texas, let alone the central U.S.,” Brand said.

“So that’s how we came to, this is the best opportunity I’ve ever seen. Plus, the most fun opportunity we’ve seen, combining everything I love.”