After closing an oversubscribed Fund II at the beginning of last summer, we are well positioned to continue investing in seed-stage women-led companies. We are happy to kick off 2023 by sharing news of our most recent investment, our first exit, our portfolio’s 2022 impact report and more.

A new investment: Refiberd

We are excited to announce a new investment into Refiberd. Refiberd is building a textile recycling system that converts discarded textiles into new reusable thread, through an integrated AI-enabled sorting and chemical recycling process.

Refiberd’s system has two stages: 1) an AI and robotics-based system which sorts discarded clothing by material and color, and 2) an eco-friendly chemical recycling process which converts the sorted textiles into new Refiberd thread.

The company was co-founded by three female engineers, Sarika Bajaj (CEO), Tushita Gupta (CTO), and Mingyue (Ida) Wang (CMO) at the start of the pandemic to tackle global fabric waste. True Wealth Ventures led their Seed financing at the end of last year and Sara took a board seat. To learn more about the company and how it is tackling the 93+ million tons of textile waste produced annually, read about them here.

Our First Exit out of Fund I

We’ve hit a big milestone with our first exit from True Wealth Ventures Fund I! Solstice, which offers a turnkey solution for the community solar industry, has been acquired by MyPower, a wholly owned subsidiary of the respected Japanese conglomerate Mitsui, which recently made the strategic decision to expand its clean energy operations in North America. MyPower seeks to use Solstice as their residential brand to accelerate Solstice’s momentum at a key inflection point in the fight against climate change, giving more people and companies in the U.S. access to more affordable, green energy via community solar.

Reflecting on our overall Fund I portfolio, we continue to be the only seed-stage fund we know of that has a zero-loss ratio after starting to invest in the 2016-2018 time period and having survived a global pandemic. Our perseverant women founders continue to impress and inspire us with their ability to adapt and maintain their passion to scale their solutions in an evolving market.

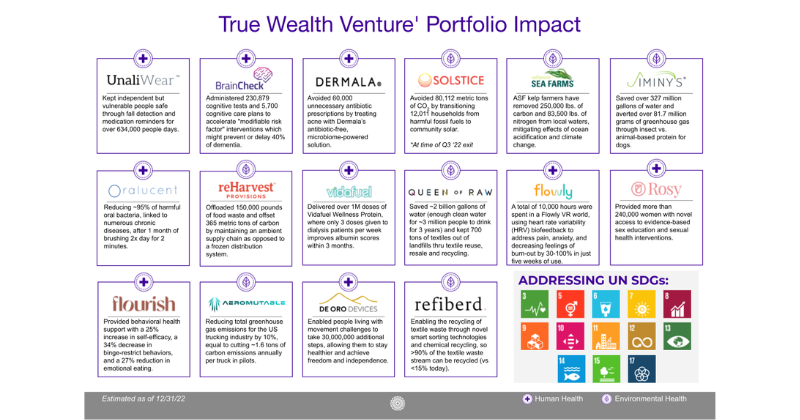

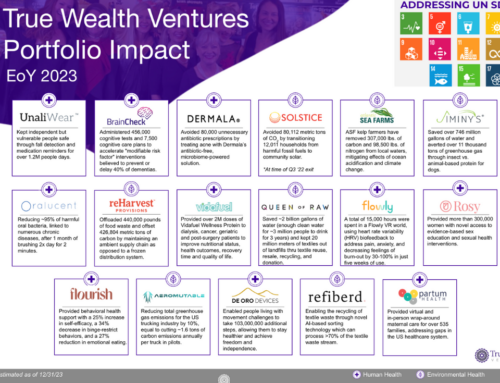

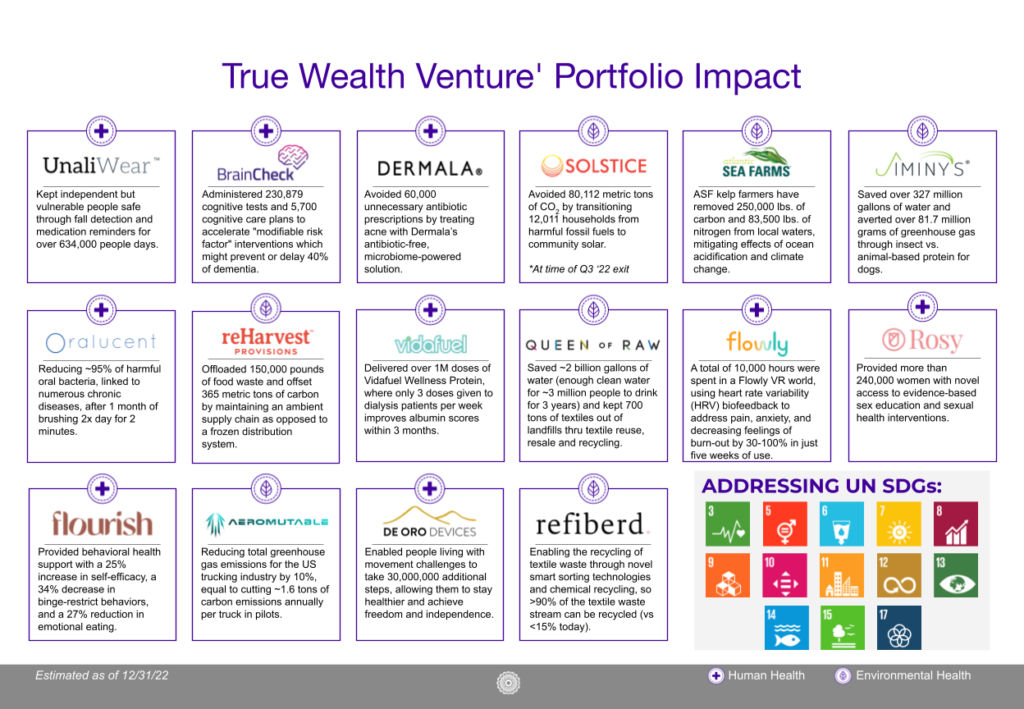

Portfolio Companies Making an Impact

We are pleased to share the highlights of our annual impact report. We are proud to see the positive impact that our portfolio companies are having on their respective industries and communities. Despite the challenges over the last several years, ALL of our companies have continued to innovate and adapt, resulting in meaningful progress toward their long-term human and environmental impacts.

Please let us know if you would like to see the full report using the UN SDG’s and GIIN’s 5 dimensions of impact as a framework for each company.

Interested in investing in Venture Capital?

Are you interested in hearing when True Wealth Ventures Fund III is open for investment? If you’re an accredited investor, sign up here, and we’ll notify you when we start fundraising, which will likely be in 2025.

Would you like to learn more about why only 1.9% of VC dollars were invested into women-founded companies in 2022, how to fix it and what it means to invest in a venture capital fund? We will be hosting our first “A VC Primer for Women Investing in Women” session on Thursday, February 16th 2-3 PT. To register for this upcoming session, click here.

Can’t make it? Sign up here to be notified of future sessions.

Lastly … send us women-led companies!

There’s never been a better time to be investing in early-stage women-led companies, so please send us any whose core focus is improving environmental or human health (more on our investment focus).

Just email us or send them our simple web form for founders to review our criteria and submit their company for our review.

Don’t miss another update from True Wealth Ventures! Sign-up for our newsletter here.