The Austin-based investment firm raised $19.1 million, which it will use to back women-led health tech ventures and sustainable consumer brands.

The founders cite high performance of women-run startups, lack of VC funding for women entrepreneurs and women’s overwhelming influence in consumer purchasing and healthcare decision making as reasons for launching the fund. (We know of at least 58 funds and 13 investment toolsfocusing on women.)

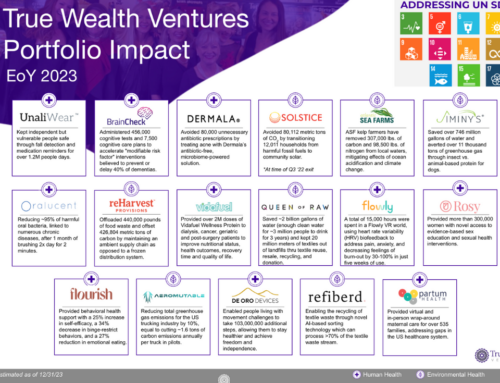

The founders chose Austin as a base because there are “no other early-stage funds targeting this market in the central/southern part of the US.” True Wealth intends to invest in 12 early stage startups.

Original article posted here.