Sara Brand and Kerry Rupp, general partners of True Wealth Ventures

The general partners of True Wealth Ventures want to see more female led companies get venture capital investment.

And they want to see more female venture capitalists making investments in the industry.

The $20 million True Wealth Ventures fund invests in women led companies in the sustainable consumer and consumer health industries.

Sara Brand and Kerry Rupp, general partners of True Wealth Ventures, founded the VC firm after identifying problems in the VC industry. They recently sat down with Silicon Hills for an interview for its Ideas to Invoices podcast.

Brand, who has three degrees in mechanical engineering, spent 20 years in the semiconductor industry and owns a brewery, (512) Brewing Company with her husband. She spent time in venture capital, in technical roles, operational roles and management consulting.

“Looking back, I was pretty much the only woman,” Brand said. “Mechanical engineering, beer, semiconductors, VC at my last role at Advanced Micro Devices I was asked to be the executive sponsor of the global woman’s forum. It was at that point that I realized that I was the only vice president that was a woman that had any technical or operational background and I had not realized that and was very surprised to find that out because I had been so used to being pretty much the only woman. But I couldn’t believe that that was the case.”

That’s when Brand began considering the numbers behind what it means to have more women in leadership positions. She documents an extremely high correlation between women in leadership positions and outstanding financial performance, Brand said.

“So, I started getting really interested in what companies could do to improve or increase the number of women in leadership positions,” Brand said. “And then knowing I wanted to get back into venture capital already, I started looking at the venture capital space and saw that it was a humongous gap in the venture capital space.”

Because of the state of where things were and the opportunity, Brand co-founded True Wealth Ventures with Rupp.

“At the time, I had been the CEO of DreamIt Ventures, a startup accelerator operating in multiple cities with a $20 million fund,” Rupp said. “They had done a program specifically focused on woman entrepreneurs because there was an underrepresentation of women, compared to men in all the accelerators.“

“I had some really strong woman entrepreneurs that had gone through my Dream It programs, but had struggled to get funding,” Rupp said. “And I know it was explicitly in some cases because they were female because they had instances where they met with venture capitalists who told them we don’t invest in women.”

Overall, True Wealth Ventures will invest in 12 companies during the next four years with initial investments ranging from $250,000 to $500,000.

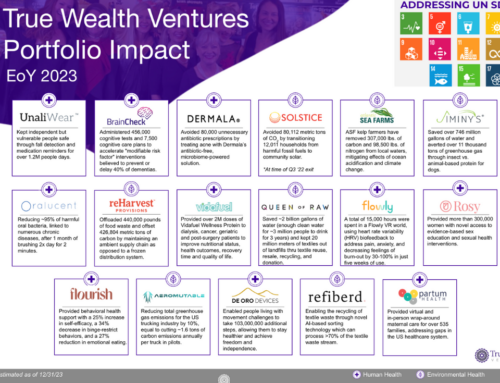

So far, True Wealth Ventures has looked at hundreds of companies and has invested in two: UnaliWear and BrainCheck. UnaliWear is a smart watch for seniors created by Jean Anne Booth, a serial entrepreneur, in Austin. BrainCheck is a mobile brain health tracking solution that was the result of 20 years of research at Baylor College of Medicine and later spun out of the TMCx Innovation accelerator in Houston. Yael Katz is the CEO of BrainCheck.

“One of the things that is pretty fascinating about our investors is that 80 percent of them to date are women and that is really pretty unexpected and unheard of in the venture capital industry,” Rupp said.

Somewhere between four to six percent of venture capital partners today are women, but if you look at who is making investment decisions is might be closer to one percent of the venture capital investors, Rupp said.

“We are bringing a different audience to VC investing,” Rupp said.

A lot of the investors are women in a couple or family office or foundation that made the investment decision, Brand said. Today, women are said to hold 40 percent of the U.S.’s investable assets, but that is projected to go up to two-thirds of all U.S. investable assets by 2030, Brand said.

“Women haven’t been investing very much in venture capital or even as angel investors – having those numbers increase is really exciting on making sure we’re sustaining the innovation economy in this country,” Brand said.

True Wealth Ventures’ isn’t promoting a feminist manifesto, but its investing strategy is rooted in a deep statistical analysis that shows businesses and startups with women in leadership positions outperform ones that don’t have women.

A McKinsey & Co. study called “Women Matter” showed that in their database of Fortune 500 publicly traded companies, the top quartile of companies in that database with women in leadership positions saw 41 percent higher return on equity and 56 percent higher return on earnings, Brand said.

Looking at the venture capital industry, Brand saw there was a massive disconnect even more than the corporate world, she said.

“If you look at who is getting the money in venture capital, less than 3 percent of all VC backed companies are women led and women CEOs and about two percent of overall VC dollars are going to companies with women CEOs,” Brand said. “Yet there are similar studies that show similar outperformance for women led companies.”

Kaufmann Foundation did a study that showed women-led VC backed companies saw 35 percent higher returns and 12 percent higher revenues using a third less capital, Brand said. Yet if you look across the entire country, there are very few funds that have women general partners that have any kind of gender diversity strategy, Brand said.

“There are about a half dozen,” she said. “And they are generally in New York and California so we’re the whole strategy for the central part of the country.”

Unconscious bias exists in the venture capital world in the pitch process, Brand said.

There are crowdfunding platforms like Kickstarter in which 35 percent of the successful deals are led by women, compared to 2.7 percent of venture backed VC companies are led by women, Brand said.

There’s been a bro culture in the technology industry for a long, long time and it still exists, but the reactions to it are changing, Brand said.

“A year ago, the Ellen Pao trial to now where firms are taking investors out of leadership positions within 24 hours of alleged harassment accusations becoming public,” Brand said. “That is unprecedented.”

Pao, a female venture capitalist, filed a gender discrimination lawsuit against her former employer Kleiner Perkins Caufield & Byers. She lost the lawsuit but the case did draw massive attention to the lack of women in the venture capital industry. Earlier this year, a former Uber Engineer, Susan Fowler, wrote a blog post outlining alleged sexual harassment at Uber during her time there. Recently, Uber’s board fired its CEO Travis Kalanick stemming from allegations of a workplace hostile to women. And an Uber board member also resigned in June after making a sexist comment during a board meeting.

“We need more women in VC firms,” Rupp said.

“There are so many all men VC firms, why can’t there be some more all women VC firms?” Rupp asked.

The lack of female VCs and the lack of female led companies getting funding is a systemic problem that we need to think about more broadly, she said.

This article originally appeared here.