This originally appeared in San Antonio Business Journal

An Austin-based venture capital firm with a unique investment strategy has plans to evaluate and potentially invest in San Antonio area technology startups in the coming months.

True Wealth Ventures, co-founded by Sara Brand and Kerry Rupp, pitched their idea to the San Antonio Angel Network investors recently and expect to find opportunities in the Alamo City. In part because of San Antonio’s historically higher rate of women-led companies when compared to other Texas markets.

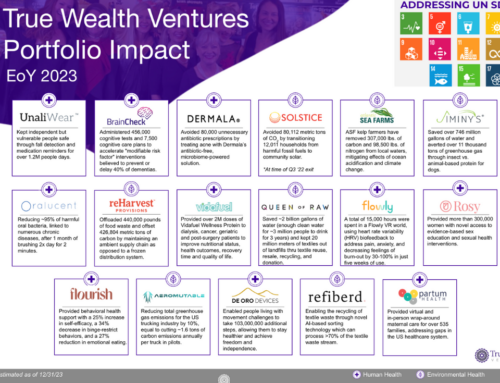

True Wealth Ventures focuses on investing in early stage technology companies with diverse executive teams who are selling products or services in the health or sustainability sectors. True Wealth’s investment philosophy is that if women-led companies are building consumer products purchased by women, those businesses have a higher success rate.

“Women are often having to make their own healthcare decisions, those for their children, often their elderly parents, and sometimes even their spouses,” Rupp said. “When I ran an accelerator, I evaluated thousands and thousands of deals per year, and made selections on limited data. Whereas Sara did a lot of deep diligence in the corporate world during M&A [merger and acquisition] activity before one company acquires another. So we bring a competitive approach to how to do due diligence.”

The True Wealth Ventures Fund I raised $4.7 million during the summer of 2016 across 19 investors, according to records on file with the U.S. Securities and Exchange Commission. The fund offered $20 million in securities at the time but the venture partners declined to disclose how much more has been raised in the round that’s not yet closed.

Rupp is also a faculty member of the National Science Foundation’s Innovation Corp., a program for emerging companies to apply for grants to fund research that will be used to commercialize products.

“We are looking for someone who has a significant stake in the [capitalization] table — not a token female,” Rupp said referring to the equity split for startup founders. “In companies with potentially $100 million exit in the next 5 to 7 years.”

Brand is also a founding investor in Portfolia’s Rising Tide Fund, an angel investing network for women through the Kauffman Foundation. She’s also a senior advisor for the health internet of things program at Dell Medical School at the University of Texas at Austin, a council that helps startups commercialize products at the university. Brand is the former venture capital fund manager for Fremont Ventures in San Francisco where she managed a fund of $150 million.

“What we want is more diversity in a founding executive team so it doesn’t have to be all women, just more women with significant influence,” Brand said. “We think there is a financial advantage to having gender diverse teams.”

About 22 percent of businesses in the San Antonio metro area are women-owned. But only high-growth companies with products or services that can scale quickly are typically eligible for venture capital. The pair cited that the average revenue for a woman-owned company in San Antonio is $1.6 million and have on average 43 percent revenue growth.

“Many of those businesses are hamstrung by lack of access to capital as opposed to ambition,” Rupp said, citing a study by First Round Capital, a San Francisco venture capital firm.

Rupp suggested that the research showed that women-led technology startups outperform male-led startups, but only if those women had access to capital during the seed stage. The venture capital firm expects initial investments to be between $250,000 and $500,000. One of its first portfolio companies is Austin-based UnaliWear, a smart watch for senior citizens.

“Their number one finding was that companies with a woman founder performed 63 percent higher in terms of returns,” she said.