This is one of my favorite subjects and the underlying impetus to start True Wealth Ventures Fund 1. While I was the executive sponsor for a Fortune 500 company’s global women’s form, I became familiar with the studies showing that large companies with more women in leadership performed significantly better financially, like 41% higher return on equity and 56% better operating results according to a ground breaking McKinsey study. One of my favorite studies shows that Fortune 500 companies that had at least three women board directors (WBDs) for at least five years, outperformed those with zero WBDs by 84% return on sales (ROS), 60% return on invested capital (ROIC) and 46% return on equity (ROE).

Then, after shockingly realizing I had never personally interacted with a woman in venture capital at a portfolio company or on a deal, I started looking into the small company and venture funded start-up numbers to see if the performance numbers looked similar. It turns out that they do. In fact, the research shows that gender diversity is particularly valuable where innovation is involved, and we see that women-led private technology companies achieve 35% higher return on investment, and, when venture-backed, bring in 12% higher revenue than male-owned tech companies. Other research shows similar results for venture-backed organizations that are the most inclusive of women in top management to the tune of 34% higher total return to shareholders, but also finds that these women-run companies achieved comparable early-year revenues, using an average of one-third less committed capital. Other research shows that successful startups have twice as many women in senior roles than unsuccessful companies and that firms with just one or more women executives are more likely to turn a profit, go public, or sell for greater money than raised. Analyzing U.S. Census data to look more generically at women-owned businesses overall with more than $10 million in revenue as a metric for success, we see 47% higher growth with women-led companies than all companies with revenue greater than $10 million.

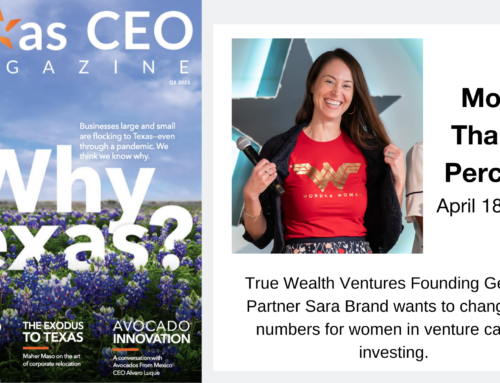

Let’s take just a quick look at the implications for venture capital (VC) fund performance too. In my last blog I referenced the fact that there are only 4.2% of women in the deal making, partner level jobs in venture capital firms, and the number of women in VC seem to have a direct correlation to the amount of VC money going to women-led start-ups with women CEO receiving 3% of the total VC dollars ($1.5B of 50.8B from 2011-2013). So, how did these risky firms investing in women led businesses fare? An SBA sponsored study that used all investments by U.S. based VC firms in U.S. based companies between 2000 through 2010 found that indeed VC firms that invest in women-led businesses performed better than all men-led businesses. No surprises there given the underlying numbers. Yet, Shark Tank’s investing star Kevin O’Leary recently surprised himself when he accidentally discovered that the companies returning on his investments were all led by women and he didn’t “have a single company run by a man that’s outperformed the ones run by women.”

“Women Matter 2010”, McKinsey & Company

“The Bottom Line: Corporate Performance and Women’s Representation on Boards“, Catalyst

“Women in Technology: Evolving, Ready to Save the World”, Kauffman Foundation

“Whitepaper: High Performance Entrepreneurs Women in High Tech“, Illuminate Ventures

“Women at the Wheel: Do Female Executives Drive Start-Up Success?“, DowJones

“The 2014 State of Women-Owned Business Report”, American Express

“Venture capital’s stunning lack of female decision-makers”, Fortune

“Diana Report Women Entrepreneurs 2014: Bridging the Gender Gap in Venture Capital”, Babson College

“Venture Capital, Social Capital and the Funding of Women-led Businesses”, SBA

“Kevin O’Leary of ‘Shark Tank’ invests in 27 companies and says the only ones making money have female CEOs”, Business Insider