Sara Brand and Kerry Rupp of Austin, Texas-based True Wealth Ventures defy many trends in the venture capital world. The investors, who raised $19.1 million for their first fund in 2018, have just closed on $35 million in new capital for their firm’s second fund.

In an ecosystem where women make up just 2.4% of partners at venture firms, and considering that the vast majority of first-time funds never actually make it to closing, Brand and Rupp are used to beating the odds. Their investment approach is just as unique in the VC world as their backgrounds: they invest exclusively in seed-stage startups led by women, which they define as having at least one woman with “signifcant decision-making power” on the founding or executive team of the company.

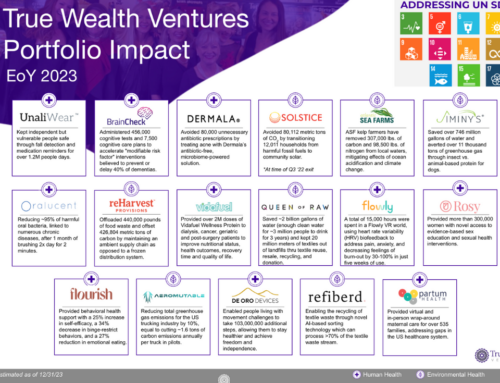

Their strategy is a rarity in light of the fact that less than 2% of venture capital funding went to all-female founding teams last year, marking a five-year low. True Wealth’s portfolio from Fund I contains companies including cognitive health startup BrainCheck and kelp and seaweed producer Atlantic Sea Farms. “We were the largest fund ever raised with an explicit gender diversity strategy for our Fund I,” Rupp said. “We were really early to the market, and when we had that kind of organic press back in the day about the fact that we are writing checks to women entrepreneurs, and how rare that was, we just had a firehose of incoming deal flow that lasted for years, frankly.”

In addition to its focus on women-led companies, True Wealth Ventures also only invests in companies they believe are making a positive impact in either health or sustainability, Brand and Rupp told TechCrunch. The firm has a zero loss ratio from Fund I, the pair added, meaning all of the companies it has invested in are still operational — no small feat for a group of early-stage startups that have had to weather a global pandemic.

For their second fund, Brand and Rupp will largely continue with the same strategy from Fund I, sticking to making about 15 investments in total after making 12 out of the first fund, they said. One key difference with this new fund, they continued, is their plan to write larger checks this time around — up to $1 million per investment compared to the ~$500,000 average investments True Wealth’s first fund made.

“Now, we want to be able to write up to a million dollars [per] first check, because we do usually lead the deals, take a board seat, and take a big role. We have a lot of conviction around our investments and have a relatively concentrated portfolio,” Brand said. Fund II has already invested in three companies since its first close in May last year: trucking and aerospace company Aeromutable, mobility device manufacturer De Oro Devices and health and nutrition platform Flourish, according to Rupp and Brand. Of those companies’ six total co-founders, half of whom are women, two are Black, two are LatinX and one is Native American, they added.

True Wealth also plans to bring on its first full-time employee outside of Rupp and Brand themselves, an associate who will start next month, according to the partners. Its team already leverages its network of venture fellows and interns to help with sourcing and diligence, they added. While they originally set out exclusively focused on backing women founders, the duo has found a “secondary mission” in educating women limited partners, who make decisions largely on behalf of family offices, and foundations, on how to invest in venture capital. More than 80% of the LPs in both funds are women, Brand explained.

“We actually did a poll of our LPs and found out that of those women, the vast majority had never invested in a venture capital fund before, and the vast majority of those women had never been invited to invest in a venture fund before,” Brand said. “We realized, in retrospect, that seems obvious with the lack of women in VC funds making investment decisions, and the lack of women entrepreneurs getting VC dollars. This is just a very male-dominated ecosystem.”

The firm hosts educational events in group settings to educate LPs about venture capital’s risk profile, capital costs and structure, as well as to introduce those investors to their portfolio founders. “We think that diversity of the LP base feeds into our priorities and what our investors care about, and the solutions we want to see in the world and therefore what we invest in … When women come into increased wealth, they reinvest that into their family and community’s health, education and welfare at twice the rate of men,” Rupp explained.