This article originally appeared on Dallas Morning News.

THE CONNECTORS: Conversations with visionaries, investors and entrepreneurs from North Texas who are making a mark in the business world

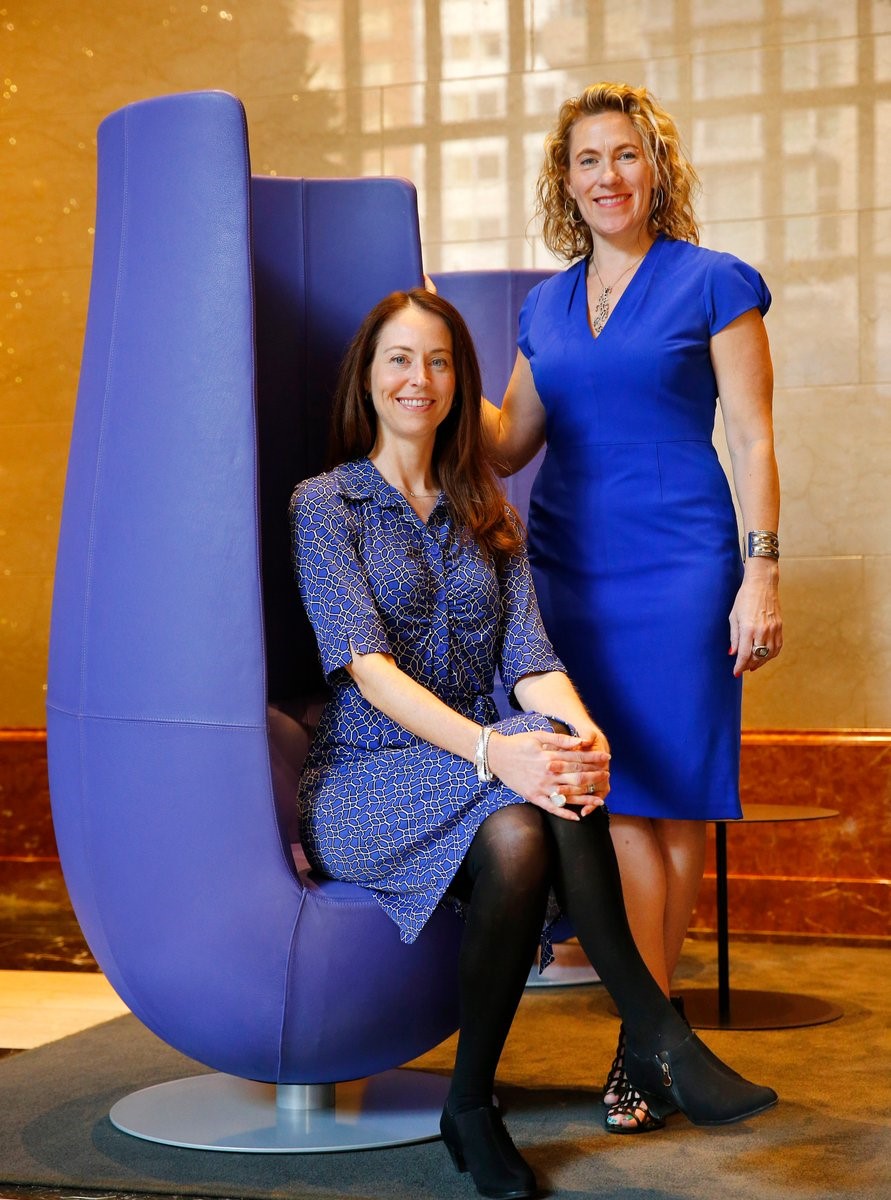

After years of working in Austin and the San Francisco Bay Area, Sara Brand had a stunning realization: She had never met a woman in venture capital. She’s already increased the number by starting her own venture capital firm, True Wealth Ventures, last year. She met Kerry Rupp through an acquaintance, and Rupp came on as a general partner.

Brand has worked as a semiconductor researcher, venture capital professional in San Francisco and founder of (512) Brewing Co. Rupp recently served as CEO and general partner of DreamIt, a startup accelerator and early-stage fund focused on digital health and education technology. Now, as True Wealth Ventures, they look for promising women-led companies focused on consumer health or sustainability-related products and technologies.

True Wealth Ventures has raised more than $4.7 million so far and plans to raise a total of $20 million by the end of 2017. More than 80 percent of the fund’s investors are women, Rupp said.

Brand and Rupp recently spoke to The Dallas Morning News during a visit to Dallas. Their comments have been edited for brevity and clarity.

You both have really interesting career and educational backgrounds. What inspired you to focus on a venture fund and women-led businesses?

Brand: My background work-wise was in more technical roles originally, and then I went into consulting for McKinsey in the Bay Area. Then I went into venture capital. I loved it because it was the perfect blend of using my technical background, but also helping companies with whatever they need business strategy-wise. I knew I really wanted to do that long-term. I went to get operational experience under my belt before returning to VC.

Rupp: When I ran DreamIt, we had 150-something companies during my tenure. Many of them had strong female leadership. Multiple of my strong companies really struggled to get funding, and two of them were told by investors that the investors did not invest in women. Those are things I wouldn’t expect someone to think – never mind say out loud – but it happened more than once to people I know. Knowing that kind of bias still existed in the marketplace, especially when these [women-led] companies tend to outperform, made for a great opportunity from a financial return perspective.

The tech industry is notoriously male, as you know. What will you do to help close that gender gap?

Rupp: Our role will be to create the role models and the case studies of women who have done it. There’s always that ‘You can’t be what you can’t see’ phrase. By funding these very capable women who are going to have great business performance that gives examples to girls and women.

Also, we’ll show a path and be role models as investors. Depending on what numbers you look at, 96 percent of VCs are men. Some of the data suggests 99 percent of the investment decisions are made by men because those women in senior leadership at VCs are not investment decision-making partners. So just being women VCs is incredibly rare.

Rupp: There’s this self-fulfilling prophecy. There’s already all these startups in Silicon Valley, so new VCs go to Silicon Valley. It’s a steamrolling kind of effect.

It is interesting that some of the bigger funds in Texas have left over the last several years – Sevin Rosen in Dallas and Austin Ventures in Austin. To some extent, the model for VC has shifted away from really big funds that are doing everything.

In a small fund like ours, we can have a great multiple on the fund without having to have a Google or an AirBnB in our portfolio. So I think that some of it is the structure of VC has changed, and that’s led to revolution in new types of smaller funds coming to the surface.

What advice do you give female founders?